Should Việt Nam implement VAT on fertilisers?

|

| A farmer applying fertiliser on the rice field. — Photo vietnamagriculture.nongnghiep.vn |

The National Assembly (NA) has introduced a draft amendment to the Value-Added Tax (VAT) Law that has drawn significant attention due to a proposal to impose VAT on fertiliser products.

This regulation is expected to impact the fertiliser market, fertiliser manufacturing and trading businesses, and especially farmers.

Việt Nam's agricultural sector has long been considered a vital pillar of the nation's economy. Despite global economic fluctuations and the impact of the COVID-19 pandemic, Việt Nam's agricultural exports have demonstrated impressive resilience, contributing significantly to economic growth.

In 2021, while most sectors suffered, agricultural exports reached US$42.5 billion, growing by 2.74 per cent and contributing 23.54 per cent to the national GDP. The sector's upward trajectory continued in 2022 and 2023, with exports exceeding $53 billion. In the first ten months of this year, agricultural exports hit over $51.7 billion, marking a 20.2 per cent increase compared to the same period last year.

However, a contentious debate has emerged around applying VAT to fertilisers, an essential input in agricultural production. The question at the heart of the discussion is whether Việt Nam should impose a 5 per cent VAT on fertilisers to enhance local production capabilities or maintain the current tax exemption to support farmers.

Since the NA passed Tax Law 71 in 2014, fertilisers have been exempt from VAT in Việt Nam. The intention behind this exemption was to reduce production costs and support farmers by making fertilisers more affordable. However, this policy has led to several unintended consequences that have sparked calls for reconsideration.

Without the ability to claim input tax refund, domestic fertiliser manufacturers face higher production costs. This situation has led to increased prices for locally produced fertilisers, making them less competitive against cheaper imported alternatives.

Data from the Việt Nam Fertiliser Association has revealed that since the exemption of VAT on fertilisers, import volumes have fluctuated between 3.3 and 5.6 million tonnes, with a total value ranging from $952 million to $1.6 billion. Meanwhile, domestic production capacity has drastically shrunk, falling from 3.5 million tonnes per year before 2014 to a mere 380,000 tonnes per year since 2015. This dependency on imported fertilisers threatens Việt Nam's agricultural self-sufficiency and poses risks to food security, especially if global supply chains are disrupted.

|

| Growing vegetables in a cooperative in Hà Nội. — Photo courtesy of Petrovietnam |

Arguments in favour of imposing VAT on fertilisers

Proponents of applying a 5 per cent VAT argue that such a move could benefit both the agricultural sector and the broader economy.

Phạm Văn Hòa, a member of the NA's Legal Committee, said that a report from the NA Standing Committee indicates that the 2014 VAT exemption for fertiliser has significantly disadvantaged domestic fertiliser manufacturers.

Since these companies cannot deduct VAT on input materials, it gets added to their costs, including taxes. This raises production costs for local fertilisers, making them less competitive with imported ones, which is unfair to domestic producers.

“I agree with the Standing Committee’s proposal to reinstate a 5 per cent VAT on fertiliser. Currently, fertiliser is a price-stabilised product, and the State will regulate prices to ensure they do not rise too sharply,” Hòa said in a recent seminar on this issue.

According to tax expert Nguyễn Văn Phụng, introducing VAT on fertilisers could lead to more competitive pricing, benefitting not just farmers but also enhancing Việt Nam’s agricultural exports.

Furthermore, by levying VAT on fertilisers, the Government could encourage manufacturers to invest in eco-friendly production technologies, aligning with the national goal of sustainable agricultural development. There is also the potential for a positive impact on the State budget, Phụng said.

Việt Nam applying a 5 per cent VAT on fertilisers aligns with international trends and is lower than the VAT rates in many countries. International experience shows that countries like China, Brazil and Russia impose VAT on fertilisers, usually at lower rates than other goods. This approach helps reduce fertiliser costs, supports the growth of the domestic fertiliser industry, encourages investment in advanced, eco-friendly fertiliser technologies and promotes sustainable agricultural development.

Hoàng Trọng Thủy, an agricultural expert, supports this perspective, arguing that VAT could drive innovation in the fertiliser industry. He highlights that applying VAT would incentivise domestic producers to improve product quality, thereby reducing the reliance on imports and boosting Việt Nam’s agricultural competitiveness.

Thủy also suggests that the additional tax revenue could be channelled into training programmes for farmers, helping them adopt sustainable farming techniques and access higher-quality, environmentally friendly fertilisers.

On the other side of the debate, some argue that imposing VAT on fertilisers could increase the financial burden on farmers. Opponents of the fertiliser tax argue that it would increase costs for farmers, who are already facing low profit margins. They believe these higher costs would be passed down to farmers, reducing agricultural output, potentially threatening food security and raising food prices.

Critics also highlight that the current VAT exemption helps keep farming costs low and supports Việt Nam’s rural economy. They warn that the added complexity of VAT implementation could burden small-scale farmers and cooperatives, making compliance challenging.

To cope with this issue, Phụng suggests a phased approach in which VAT is gradually introduced, allowing time for farmers and manufacturers to adjust.

“Although farmers may have to 'endure some pain' in the short term, ensuring a balance of interests and creating a stronger foundation for the agricultural sector means that, in the long run, farmers will not suffer,” Phụng said.

He also advocates for clear communication and educational campaigns to explain how VAT could ultimately benefit farmers through reduced production costs and better-quality fertilisers.

The debate around VAT on fertilisers is not just about economics, but also encompasses environmental concerns. Most fertilisers currently used in Việt Nam are chemical-based, which can have detrimental effects on soil health and ecosystems. By applying VAT, the Government could indirectly promote the use of organic fertilisers and sustainable agricultural practices. This shift would align with Việt Nam’s commitment to sustainable development and reducing greenhouse gas emissions.

Agriculture expert Thủy emphasises that a VAT-inclusive policy could be part of a broader strategy to modernise Việt Nam’s agricultural sector. By incentivising the production and use of eco-friendly fertilisers, the country could achieve its long-term goals of agricultural sustainability, environmental protection and enhanced food security.

See also

New FTas boost development of foreign markets for Vietnamese goods

16:42 | 23/12/2024 Economy

2024 economic growth propels Vietnam into its “Rising Era”

16:34 | 23/12/2024 Economy

Organic textiles produced in Vietnam

16:25 | 23/12/2024 Economy

Vietnamese aviation achieves high USOAP-CMA ratings in the region

16:08 | 23/12/2024 Economy

Year-end stimulus expected to boost economic growth

15:37 | 23/12/2024 Economy

Domestic factors to drive Vietnam's GDP growth in 2025: VinaCapital

15:30 | 23/12/2024 Economy

See more news

Vietnam – Italy trade cooperation promises bright prospects in 2025: Trade counsellor

15:08 | 23/12/2024 Economy

PM urges concerted efforts for economic growth of at least 8% in 2025

15:00 | 23/12/2024 Economy

UAE a vital market of Vietnam in Middle East: Ambassador

14:56 | 23/12/2024 Economy

E-commerce leads digital transformation in businesses

16:53 | 22/12/2024 Economy

Industrial parks to go green, adopt sustainable models: forum

10:12 | 22/12/2024 Economy

PM urges Da Nang to lead Vietnam’s economic transformation

09:53 | 22/12/2024 Economy

Viet Nam back as ASEAN’s growth star: HSBC

16:02 | 21/12/2024 Economy

Global coffee production to surge on Vietnam, Indonesia’s rebounding output: USDA

13:02 | 21/12/2024 Economy

Vietnam, China’s special administrative region strengthen trade links

12:31 | 21/12/2024 Economy

Vietnam, China’s Hong Kong strengthening economic collaboration

16:57 | 20/12/2024 Economy

BCC eyes leader in applying biotechnology in comprehensive healthcare

10:22 | 24/12/2024 Vietnamese Brands

Kien Giang sets goals for industrial, export breakthroughs in 2025

09:07 | 24/12/2024 Trade

Party chief receives outgoing Australian ambassador

08:43 | 24/12/2024 News and Events

HGS affirms ground service quality in aviation sector

17:19 | 23/12/2024 Companies

Banking sector: Capital flows with no congestion

17:13 | 23/12/2024 Finance-Banking

Multimedia

Glorious tradition of the Vietnam People's Army

08:30 | 22/12/2024 Infographic

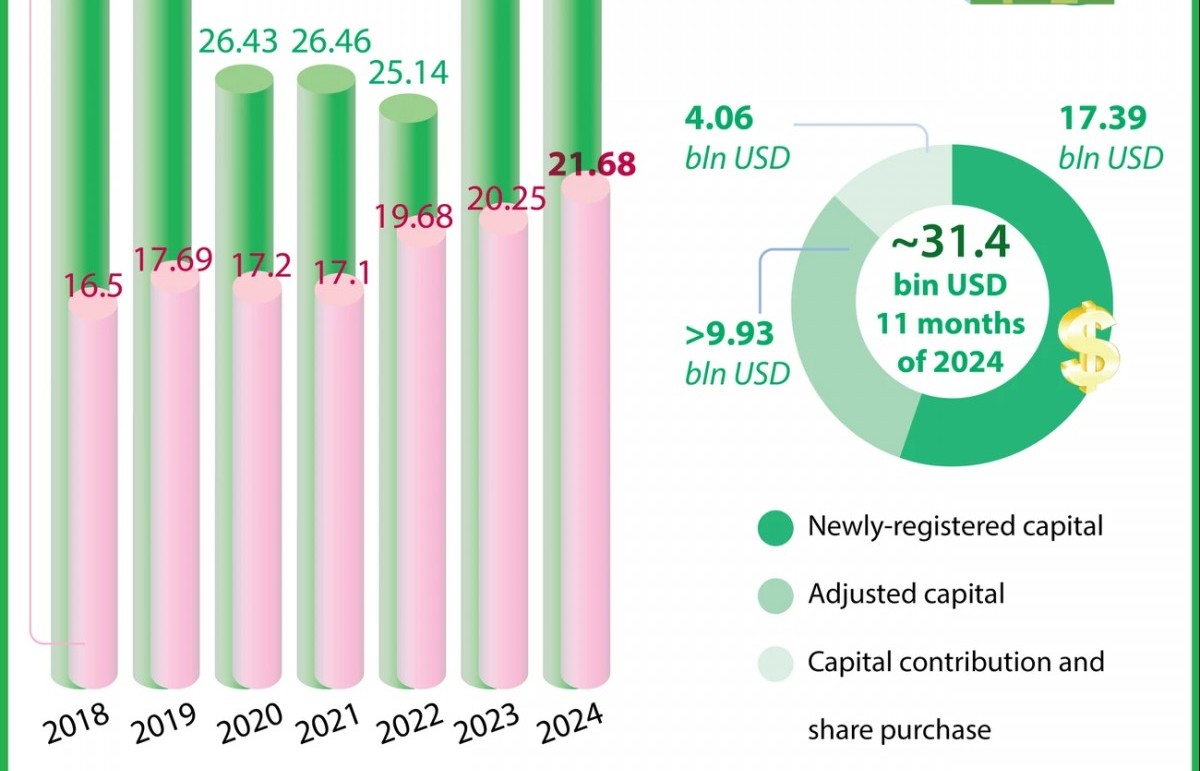

Total FDI registered in Vietnam hits 31.4 billion USD in January-November

09:02 | 17/12/2024 Infographic

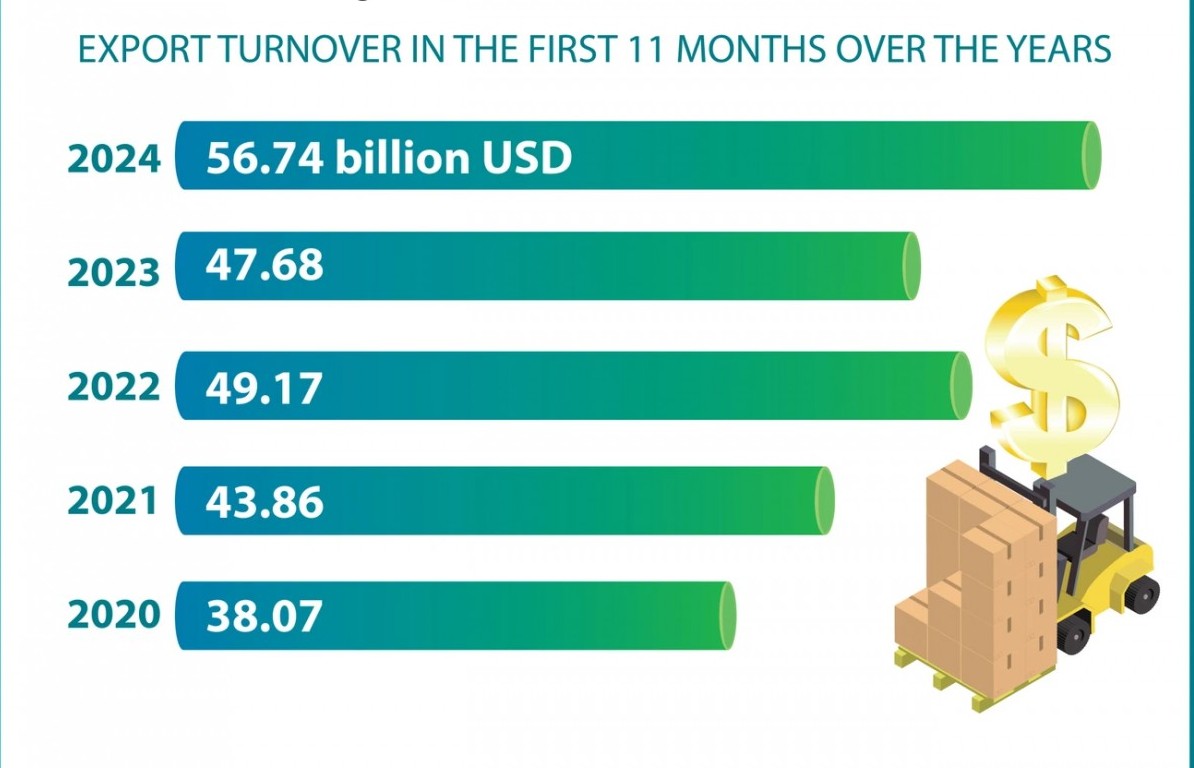

First 11 months of 2024: Import-export turnover increases 15.4%

10:55 | 16/12/2024 Infographic

11-month agro-forestry-fishery exports exceed yearly target

19:55 | 15/12/2024 Infographic

Hanoi achieves or exceeds 23/24 socio-economic targets for 2024

08:57 | 13/12/2024 Infographic

Amended Electricity Law proves MoIT’s institutional improvement success

17:06 | 23/12/2024 Policy

Ministry proposes extending agricultural land tax exemption through 2030

15:06 | 23/12/2024 Policy

Gov't targets to gradually make English second language at schools by 2030

15:45 | 21/12/2024 Policy

Nine newly-adopted laws made public

16:42 | 20/12/2024 Policy

Success story behind 500kV Circuit-3 transmission line project

16:43 | 23/12/2024 Energy

Ministry proposes incentives for renewable energy projects

16:17 | 20/12/2024 Energy

The Era of Advancement for Vietnam Industrial Park

17:15 | 19/12/2024 Industry

Vietnamese coffee sector working to meet EU Deforestation Regulation

16:38 | 18/12/2024 Industry

Nghe An Southeast Economic Zone aims to attract 1 billion USD in FDI in 2025

12:33 | 21/12/2024 Investment

Boeing aims to expand investment and cooperation in Vietnam’s defense sector

17:00 | 19/12/2024 Investment

Can Tho attracts non-state investment

10:21 | 17/12/2024 Investment

FDI remains vital contributor to boost economic growth

09:06 | 13/12/2024 Investment

Banking sector: Capital flows with no congestion

17:13 | 23/12/2024 Finance-Banking

Year-end surge in property bond issuance amid financial challenges

09:39 | 20/12/2024 Finance-Banking

Vietcombank named most valuable brand in Vietnam

16:43 | 18/12/2024 Finance-Banking

Many banks increase deposit interest rates in year-end period

16:56 | 16/12/2024 Finance-Banking

Vietnam likely to face continued turbulent weather systems in 2025

14:26 | 19/12/2024 Environment

Nature-based projects help Mekong Delta fight climate change

16:31 | 18/12/2024 Environment

11 rare monkeys released back into wild in Nghe An

09:27 | 18/12/2024 Environment

Master Plan on Sustainable Exploitation and Use of Coastal Resources announced

11:26 | 16/12/2024 Environment

Contracts worth 286.3 million USD inked at Vietnam Int’l Defence Expo 2024

17:02 | 22/12/2024 Science - Technology

Vietnam can partner with UK in developing nuclear power: Expert

12:43 | 21/12/2024 Science - Technology

Vinaphone launches fastest 5G service in Vietnam

12:38 | 21/12/2024 Science - Technology

Vietnam cooperates with Google to launch “Official Government Apps" feature

17:13 | 20/12/2024 Science - Technology

30-day free rides on 17 bus routes connected to Metro Line 1

16:14 | 23/12/2024 Society

Bac Ninh: 28 additional 4-star-rated OCOP products

23:24 | 22/12/2024 Society

HCM City’s first metro line launched after years of delay

16:47 | 22/12/2024 Society

Aviation sector strengthens smuggling, commercial fraud and counterfeit goods control

09:49 | 22/12/2024 Society

BCC eyes leader in applying biotechnology in comprehensive healthcare

10:22 | 24/12/2024 Vietnamese Brands

VAECO contributes to elevating Vietnamese aviation brand

17:11 | 23/12/2024 Vietnamese Brands

Petrovietnam keeping national “energy flame” ever burning

16:17 | 23/12/2024 Vietnamese Brands

Vietnamese products crave out a niche in UK market: Official

15:26 | 23/12/2024 Vietnamese Brands

Fireworks to light up sky over Hanoi on New Year celebration

15:13 | 23/12/2024 Culture

Vietnam’s high-end fashion targets Chinese market

10:04 | 22/12/2024 Culture

Enduring tradition of Ha Nhi ethnic minority group's costumes

13:14 | 21/12/2024 Culture

Legendary band Boney M to thrill Vietnamese audiences this Christmas

14:49 | 17/12/2024 Culture

Vietnam a green, attractive destination

16:30 | 23/12/2024 Tourism

Mekong Delta tourism continues to surge

15:21 | 23/12/2024 Tourism

Ben Thanh-Suoi Tien metro line - catalyst for HCM City's tourism development

15:17 | 23/12/2024 Tourism

Overseas tourism promotion: Breakthrough in market connectivity

14:46 | 23/12/2024 Tourism