Amendment to tax regulation on foreign suppliers proposed

|

| Many foreign suppliers take advantage of the double tax agreements to avoid tax obligations. Photo cafef.vn |

HÀ NỘI — The Government has recently proposed to amend a regulation of the Law on Tax Administration to better manage tax for foreign suppliers.

Under the proposal, the Government plans to clear up rules on foreign businesses which have argued that they do not have a fixed base in Việt Nam and are demanding huge tax refunds.

Under the current Clause 4, Article 42 of the law, for e-commerce business, digital-based business and other services of foreign suppliers ‘without having a permanent establishment’ in Việt Nam, the foreign suppliers are directly obliged to or authorise tax registration, tax declaration and tax payment in Việt Nam.

The ministry proposes to remove the phrase ‘without having a permanent establishment in Việt Nam’ in Clause 4, Article 42. The amendment will create many changes in the way that Việt Nam imposes tax on foreign suppliers.

Many foreign suppliers such as Meta, Google and Netflix are requesting Việt Nam’s tax authorities to refund the corporate income tax they paid because they do not have a permanent establishment in Việt Nam.

The amount of tax requested to be refunded is up to thousands of billions of Vietnamese đồng.

Many experts agreed with the Government’s proposal, saying that to ensure fairness among taxpayers as well as the responsibility of foreign suppliers to fulfil their tax obligations to the Vietnamese state, the phrase ‘without having a permanent establishment in Việt Nam’ should be removed.

According to lawyer Nguyễn Duy Nguyên, General Director of Hoàng Giao Law Firm, Clause 4, Article 42 stipulates the principles of tax declaration and calculation for e-commerce business, digital-based business and other services that are performed by foreign suppliers without having a permanent establishment in Việt Nam.

Thus, foreign suppliers with a permanent establishment in Việt Nam will not be directly or authorised to register for tax, declare tax and pay tax in Việt Nam. In this case, the foreign suppliers have the right to only perform the obligation to pay corporate income tax on the portion of profits allocated to permanent establishments according to the provisions of the Law on Corporate Income Tax and the Double Taxation Avoidance Agreement.

Meanwhile, according to the provisions of the Law on Value Added Tax and the Law on Corporate Income Tax, when foreign suppliers conduct e-commerce business, digital-based business and other services in Việt Nam, they are subject to corporate income tax and value added tax. This makes it difficult to collect taxes from foreign e-commerce service providers, such as in the case of online booking service providers Booking and Agoda.

“In my opinion, to create fairness among taxpayers and ensure adequate revenue for e-commerce activities, it is necessary to remove the phrase ‘without having a permanent establishment in Việt Nam’ under Clause 4, Article 42 on tax declaration and calculation principles,” Nguyên said.

The General Department of Taxation (GDT) also believes that retaining the phrase ‘without having permanent establishment’ may no longer be suitable for the current e-commerce business. Online transactions do not require a physical presence such as office, factory or staff in Việt Nam, so determining a permanent establishment becomes more complicated.

According to the GDT, double tax avoidance agreements (DTAs) were signed many years ago, but mainly applied to traditional business activities with a physical presence. Meanwhile, e-commerce business operates mainly in cyberspace, without a physical presence, which causes the application of current tax regulations to become inappropriate.

Economist Dr. Đinh Trọng Thịnh also said the application of DTAs was causing difficulties in determining tax liability. Many foreign suppliers took advantage of the DTAs to avoid tax obligations. This was a concern, especially when corporate income tax from e-commerce transactions could become an important source of revenue for the national budget in the future.

Therefore, Thịnh believes amending the provisions in Clause 4, Article 42 will open up opportunities for tax authorities to manage taxes more effectively. If the phrase ‘without having a permanent establishment’ is removed, tax authorities will have a legal basis to require foreign suppliers doing business in Việt Nam to fulfil tax obligations, regardless of whether they have a permanent establishment in the country or not.

The removal of the phrase ‘without having a permanent establishment’ in the law is a necessary step in reforming the tax system in Việt Nam. This not only ensures the State's right to collect taxes but also creates a clear legal framework for foreign suppliers operating e-commerce businesses in Việt Nam.

See also

Amended Electricity Law proves MoIT’s institutional improvement success

17:06 | 23/12/2024 Policy

Ministry proposes extending agricultural land tax exemption through 2030

15:06 | 23/12/2024 Policy

Gov't targets to gradually make English second language at schools by 2030

15:45 | 21/12/2024 Policy

Nine newly-adopted laws made public

16:42 | 20/12/2024 Policy

Resolution on construction of North-South high-speed railway issued

11:42 | 19/12/2024 Policy

PM requests no one be left behind in apparatus restructuring

09:16 | 18/12/2024 Policy

See more news

PM urges combating group interest during apparatus restructuring

10:47 | 13/12/2024 Policy

Vietnam viewed as a priority in India's Act East policy

15:20 | 12/12/2024 Policy

Australia shows interest in Việt Nam's vision of a 'rising era'

16:54 | 08/12/2024 Policy

Plan to streamline Government's organisational apparatus finalised

09:38 | 06/12/2024 Policy

Vietnam slashes government apparatus, with 9 minitries, agencies cut

10:25 | 04/12/2024 Policy

Specific plans announced to restructure Party apparatus

16:46 | 03/12/2024 Policy

Streamlining political system: Time does not wait

15:40 | 02/12/2024 Policy

Gov't urges stronger efforts in thrift practice, wastefulness prevention

15:14 | 02/12/2024 Policy

2-per-cent VAT reduction extended to the end of June

14:48 | 02/12/2024 Policy

Ministries, state agencies to undergo mergers in national apparatus overhaul

08:51 | 02/12/2024 Policy

Lao Cai – Hanoi - Hai Phong railway to foster Vietnam - China trade

09:17 | 27/12/2024 Trade

Ninh Binh promotes green tourism development

06:22 | 27/12/2024 Tourism

Agricultural, rural tourism provides opportunities for “take-off”

06:15 | 27/12/2024 Tourism

Air tickets from HCMC fully booked for Tet holiday

17:31 | 26/12/2024 Society

Cheap capital returns to banks

16:20 | 26/12/2024 Economy

Multimedia

Glorious tradition of the Vietnam People's Army

08:30 | 22/12/2024 Infographic

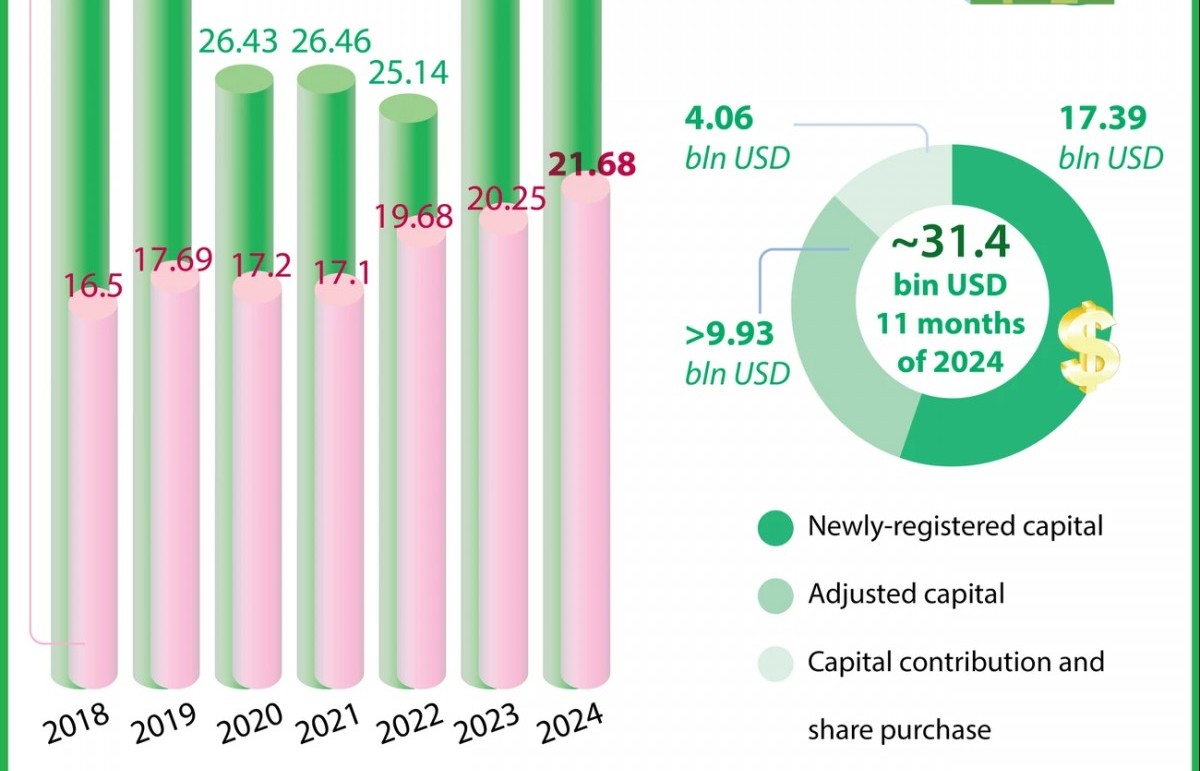

Total FDI registered in Vietnam hits 31.4 billion USD in January-November

09:02 | 17/12/2024 Infographic

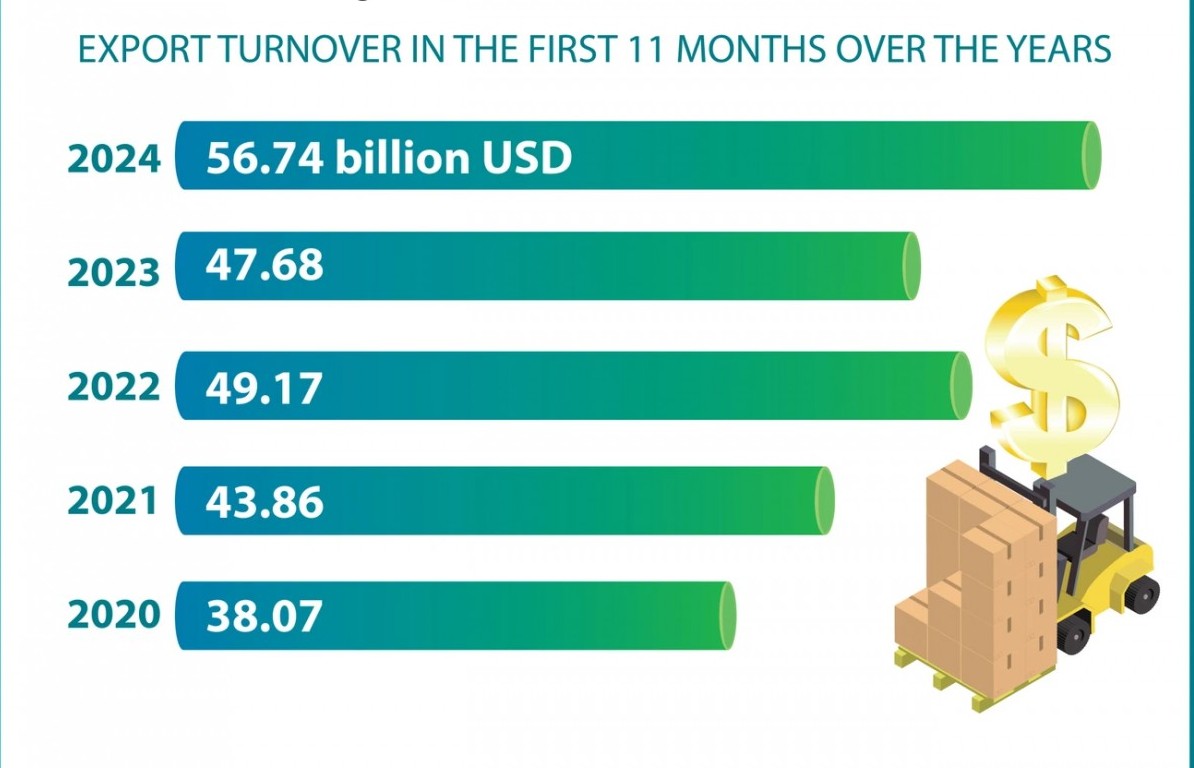

First 11 months of 2024: Import-export turnover increases 15.4%

10:55 | 16/12/2024 Infographic

11-month agro-forestry-fishery exports exceed yearly target

19:55 | 15/12/2024 Infographic

Hanoi achieves or exceeds 23/24 socio-economic targets for 2024

08:57 | 13/12/2024 Infographic

Amended Electricity Law proves MoIT’s institutional improvement success

17:06 | 23/12/2024 Policy

Ministry proposes extending agricultural land tax exemption through 2030

15:06 | 23/12/2024 Policy

Gov't targets to gradually make English second language at schools by 2030

15:45 | 21/12/2024 Policy

Nine newly-adopted laws made public

16:42 | 20/12/2024 Policy

Industry sector asked to urgently restart Ninh Thuan nuclear power project

14:35 | 24/12/2024 Energy

Success story behind 500kV Circuit-3 transmission line project

16:43 | 23/12/2024 Energy

Ministry proposes incentives for renewable energy projects

16:17 | 20/12/2024 Energy

The Era of Advancement for Vietnam Industrial Park

17:15 | 19/12/2024 Industry

Vietnam increasingly attractive to foreign investors

14:17 | 24/12/2024 Investment

Nghe An Southeast Economic Zone aims to attract 1 billion USD in FDI in 2025

12:33 | 21/12/2024 Investment

Boeing aims to expand investment and cooperation in Vietnam’s defense sector

17:00 | 19/12/2024 Investment

Can Tho attracts non-state investment

10:21 | 17/12/2024 Investment

Banking sector: Capital flows with no congestion

15:35 | 25/12/2024 Finance-Banking

Cashless payment requires biometric data updating from January 1, 2025

10:30 | 24/12/2024 Finance-Banking

Year-end surge in property bond issuance amid financial challenges

09:39 | 20/12/2024 Finance-Banking

Vietcombank named most valuable brand in Vietnam

16:43 | 18/12/2024 Finance-Banking

Sowing millions of seeds to green Vietnam’s shared home

15:08 | 24/12/2024 Environment

Dong Thap revives red-crowned crane population

14:29 | 24/12/2024 Environment

Vietnam likely to face continued turbulent weather systems in 2025

14:26 | 19/12/2024 Environment

Nature-based projects help Mekong Delta fight climate change

16:31 | 18/12/2024 Environment

Innovative startup ecosystem witnesses strong development

09:21 | 25/12/2024 Science - Technology

Top 10 science and technology highlights in Vietnam in 2024 announced

15:10 | 24/12/2024 Science - Technology

Contracts worth 286.3 million USD inked at Vietnam Int’l Defence Expo 2024

17:02 | 22/12/2024 Science - Technology

Vietnam can partner with UK in developing nuclear power: Expert

12:43 | 21/12/2024 Science - Technology

Air tickets from HCMC fully booked for Tet holiday

17:31 | 26/12/2024 Society

Bac Ninh Province focuses on year-end market stabilization

16:21 | 25/12/2024 Society

Vietnam aims to reduce greenhouse gas emissions in agriculture production

08:57 | 25/12/2024 Society

Metro Line 1 serves 150,000 passengers on opening day

15:35 | 24/12/2024 Society

PV GAS sets many records, exceeds 2024 production, business plan

16:57 | 25/12/2024 Vietnamese Brands

“PV GAS - Green Energy Journey” marathon: Act for health, act for the environment

06:00 | 25/12/2024 Vietnamese Brands

PV GAS reviews maintenance and repair of gas facilities in 2024

15:27 | 24/12/2024 Vietnamese Brands

Vietnamese products make waves at Malaysia’s halal festival

15:06 | 24/12/2024 Vietnamese Brands

“City Tet Fest - Thu Duc 2025” New Year Festival to be held soon

16:33 | 25/12/2024 Culture

“Xen Dong” ceremony of Thai ethnic people recognised as national intangible cultural heritage

16:24 | 24/12/2024 Culture

Fireworks to light up sky over Hanoi on New Year celebration

15:13 | 23/12/2024 Culture

Vietnam’s high-end fashion targets Chinese market

10:04 | 22/12/2024 Culture

Ninh Binh promotes green tourism development

06:22 | 27/12/2024 Tourism

Agricultural, rural tourism provides opportunities for “take-off”

06:15 | 27/12/2024 Tourism

Son La rural tourism promoted

10:54 | 25/12/2024 Tourism

Vietnam aims to welcome 22-23 million international visitors in 2025

14:56 | 24/12/2024 Tourism