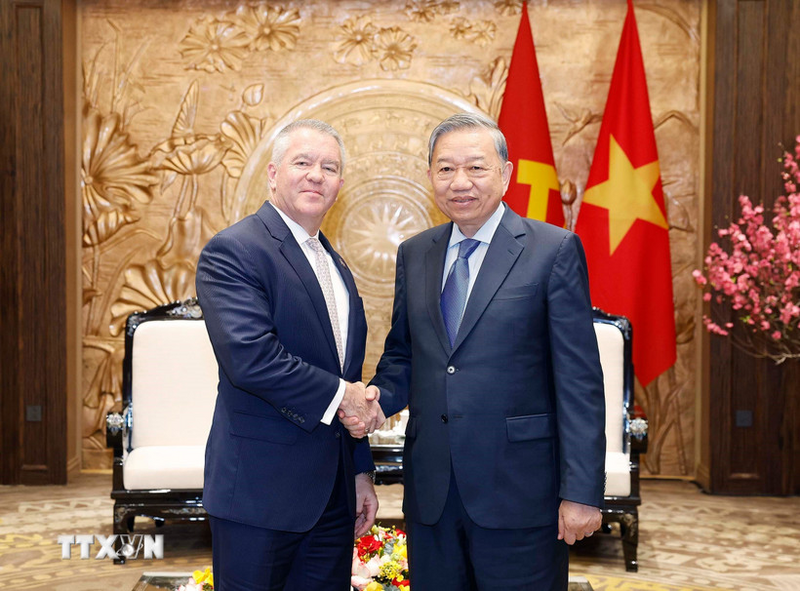

Vietnam ready to deepen comprehensive cooperation with the US

19:05 | 23/03/2025 08:30 | 15/02/2026News and Events

Vietnam’s cashew exports in January 2026 reached 50.6 thousand tonnes, valued at USD 347 million, down around 25% compared with the previous month but up more than 35% year-on-year.

According to data from the Customs Department, cashew exports in January 2026 totaled 50.6 thousand tonnes worth USD 347 million, down 25.7% in volume and 25.5% in value compared with December 2025. However, compared with January 2025, exports rose 35.0% in volume and 36.1% in value.

In 2025, cashew exports reached 766.5 thousand tonnes with a turnover of USD 5.22 billion, further affirming the commodity’s role as a key agricultural export product.

In 2025, Vietnam exported 766.5 thousand tonnes of cashews, generating USD 5.22 billion in revenue, reinforcing the commodity’s position among the country’s key agricultural export products. Building on last year’s growth momentum, exports in 2026 are forecast to continue expanding as global consumption of cashews is expected to rise, particularly in markets such as China, Japan, the Republic of Korea, Russia, Nordic countries and ASEAN member states.

Young consumers are also driving demand for cashew-based products such as cashew butter and plant-based milk. According to the Vietnam Cashew Association, to ensure long-term growth, the association has identified the development of domestic raw material sources and deeper processing as strategic priorities.

With coordinated policies, technological innovation and more disciplined market practices, the cashew sector is aiming to maintain its global leading position not only in terms of export volume and value, but also in efficiency, profitability and sustainability.

In January 2026, the average export price of Vietnam’s cashews stood at USD 6,841 per tonne, up 0.3% compared with the previous month.

The US and China were the two largest export markets for Vietnamese cashews in January 2026, accounting for 37.48% of total export volume. Exports to all major markets increased compared with January 2025, with double-digit growth recorded in markets such as the US, China, Germany, Canada, the UK, Thailand and Japan.

According to the Statistical Office of the European Union (EU), EU imports of cashews from extra-EU markets in November 2025 reached 20.29 thousand tonnes valued at USD 152.78 million, up 17.4% in volume and 20.5% in value compared with October 2025, and up 39.6% in volume and 47.5% in value compared with November 2024.

In the first 11 months of 2025, EU imports of cashews from extra-EU markets totaled 182.37 thousand tonnes worth USD 1.373 billion, up 7.0% in volume and 23.3% in value year-on-year. Germany accounted for the largest share, representing 33.5% of total EU cashew imports during the period, followed by the Netherlands with 29.31%.

Overall, cashew import demand across many EU markets increased in the first 11 months of 2025 compared with the same period of 2024. Several markets posted double-digit growth, including Germany, France, Poland, Greece, Bulgaria and the Czech Republic.

The average import price of cashews into the EU from extra-EU markets in November 2025 reached USD 7,530 per tonne, up 2.6% compared with October 2025 and up 5.7% year-on-year. For the first 11 months of 2025, the average import price stood at USD 7,532 per tonne, up 15.2% compared with the same period of 2024.

The EU’s sources of cashew supply are diverse, with Vietnam remaining the largest extra-EU supplier, accounting for 71.49% of total import volume in the first 11 months of 2025, followed by Cote d’Ivoire with 16.59%.

Overall, EU cashew imports in the first 11 months of 2025 increased from most extra-EU suppliers, except India. Notably, import volumes from several markets recorded double-digit growth, including Cote d’Ivoire (up 38.3%), Nigeria (up 23.2%) and Brazil (up 28.2%). Although EU imports from Vietnam rose by only 7.0% during the period, Vietnamese cashews continue to enjoy a significant advantage in the EU market thanks to the EVFTA. Vietnam’s market share in the EU remains substantially higher than that of other suppliers and continued to expand compared with the previous year.

Entering 2026, Vietnam’s cashew sector stands at the threshold of a new growth phase, underpinned by three key pillars: Rising global demand, improving export prices and a strong market share in major destinations. However, to sustain its leading position, the industry must accelerate supply chain restructuring, increase the proportion of deep-processed products and strengthen quality control, factors that will determine long-term sustainable growth.

19:05 | 23/03/2025 08:30 | 15/02/2026News and Events

19:05 | 23/03/2025 08:25 | 15/02/2026News and Events

19:05 | 23/03/2025 16:44 | 14/02/2026Tourism

19:05 | 23/03/2025 16:33 | 14/02/2026Home Page

19:05 | 23/03/2025 16:32 | 14/02/2026Trade