Vietnam's carbon market: Prudent approach to avoid costly outcomes

Optimising Carbon Market Design: Balancing Economic Growth and Emissions Reduction

The consultation workshop “Impact Assessment of Viet Nam’s Domestic Carbon Market in the Pilot Phase” was jointly organized by the Department of Climate Change (DCC), Ministry of Agriculture and Environment and the Energy Transition Partnership (ETP) on April 16th in Hanoi. At this workshop, Ms. Nguyen Hong Loan – Executive Director of Green Climate Innovation Consulting Co., Ltd. (GreenCIC), Leader of the Consultant Team - highlighted that for the carbon market to operate effectively in the pilot phase, it is necessary to identify design and governance options, assess the impact of each scenario, and then select the most optimal approach, ensuring harmony between economic development needs and GHG emission reduction goals.

|

| Ms. Nguyen Hong Loan – Executive Director of Green Climate Innovation Consulting Co., Ltd. (GreenCIC), Leader of the Consultant Team |

“We conducted in-depth analysis and modeled the impacts of various governance options for the Emission Trading Scheme (ETS). This provides evidence-based insights for developing the national legal framework to operationalize the carbon market in Viet Nam” - said Ms Loan .

The assessment focused on identifying three key design elements: Scope of the ETS, cap-setting, and allowance allocation. By establishing design scenarios, governance options were proposed.

Three sectors - steel, cement, and thermal power - were selected for inclusion in the ETS pilot phase, as they account for more than 50% of the total GHG emissions in each industry (while the industrial sector as a whole accounts for more than 70% of the national GHG emissions).

According to Ms. Loan, although the steel sector includes over 300 small and medium-sized facilities, the pilot phase should focus on 27 crude steel production facilities responsible for over 80% of the sector’s emissions, 31 thermal power plants, representing over 86% of emissions in the sector, and 56 clinker production facilities which contribute over 90% of emissions in the cement industry.

At the same time, allowance is allocated based on emission benchmarks, incorporating NDC emission reduction targets and sector’s growth targets. Two carbon credit offset scenarios aligned with Decree 06/2022/ND-CP and the ongoing proposed revision are considered: carbon credits offset limit at 10% (ETS10) and carbon credits offset limit at 20% (ETS20).

ETS20 Scenario: Dual Benefits for Businesses and the Economy

Presenting the economic modelling results, Mr. Ho Cong Hoa from the Academy of Policy and Development, an expert of the consultant team, shared that although the 10% and 20% offset scenarios for the conditional and unconditional markets may slightly reduce Vietnam's GDP, the impact is insignificant...

|

| Mr. Ho Cong Hoa from the Academy of Policy and Development |

The ETS enables covered sectors to meet their NDC targets in a more cost-effective manner, thereby reducing the pressure on GDP, investment and consumption.

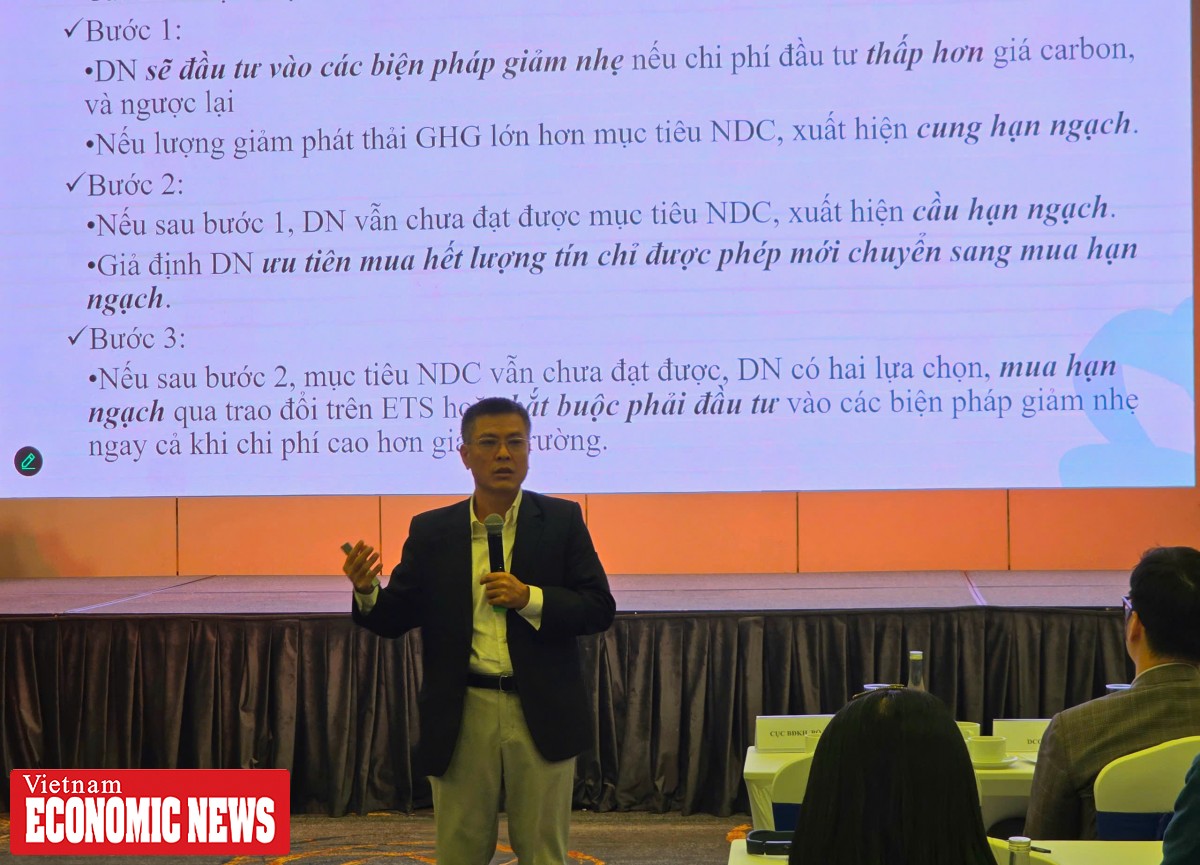

Regarding structural transformation, ETS offers greater flexibility in choosing between investing in technologies or purchasing credits, allowing them to optimise compliance costs while meeting NDC targets.

“Our modelling results show that applying ETS20 (offset limits at 20% of allocated allowances) delivers the highest effectiveness”- said Mr. Hoa. He added that the ETS also contributes to stabilizing consumer prices and controlling inflation better than no ETS scenarios.

Additionally, the ETS enables businesses to optimise compliance costs and potentially generate revenue from trading allowances.

Mr. Hoa noted that ETS20 outperforms ETS10 in balancing climate goals and economic growth, laying the groundwork for Viet Nam’s green transition and sustainable development.

A particularly notable finding is that the thermal power sector is expected to experience the greatest reduction in compliance costs and is projected to be the largest net buyer of credits/allowances in all scenarios.

Meanwhile, the cement sector, owing to its relatively low-cost abatement opportunities through technological investment, is likely to favour direct investment instead of purchasing allowances, positioning it as a potential allowance supplier.

The steel sector may also sell allowances in the ETS10 scenario due to higher investment levels, but could become a net buyer under ETS20, where higher offsetting limit and lower credit prices make purchasing more favourable.

|

| Overview of the conference |

However, the consulting team acknowledged a key limitation in the analysis: the emission data used were from 2020–2022, and the lack of facility-level direct GHG measurements may reduce the accuracy of allowance allocation and offset cost estimates. The reliance on secondary data may introduce bias and affect the robustness of the ETS design.

Experts also recommended that future research should expand to integrate additional emitting sectors beyond the three key industries, enabling a more comprehensive assessment of the national carbon credit supply–demand balance and reflecting the unique technical, cost, and behavioural characteristics of each sector.

| Furthermore, detailed assessments of ETS operational model scenarios are necessary, tailored to Viet Nam’s legal, institutional, and technological infrastructure conditions. These should include governance structures, institutional responsibilities, market operation and oversight functions, registry and clearing mechanisms, as well as the feasibility of applying blockchain and advanced digital technologies. |

Article URL: https://ven.congthuong.vn/vietnams-carbon-market-prudent-approach-to-avoid-costly-outcomes-57355.html

Print ArticleCopyrights of Vietnam Economic News, All rights reserved VEN.VN | VEN.ORG.VN